Shopping Center REITs: Winning The Last Mile

[ad_1]

Allkindza/E+ via Getty Images

REIT Rankings: Shopping Centers

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on May 30th.

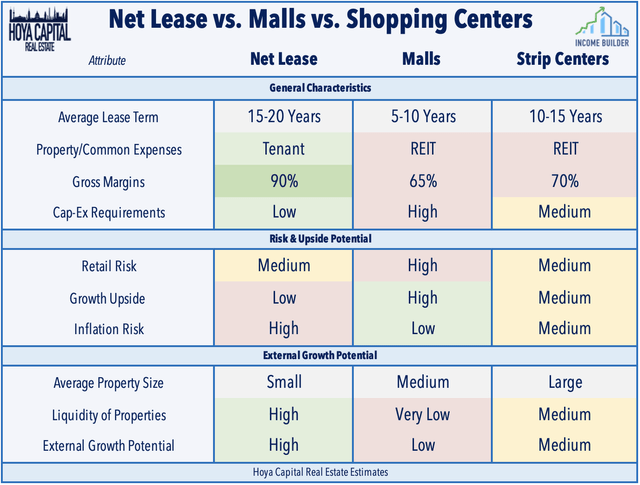

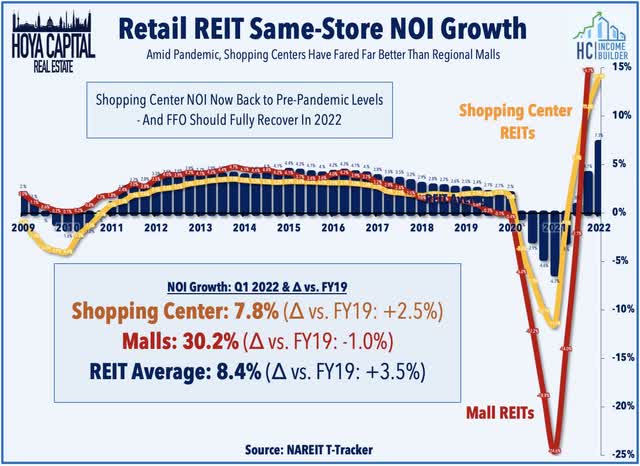

Hoya Capital

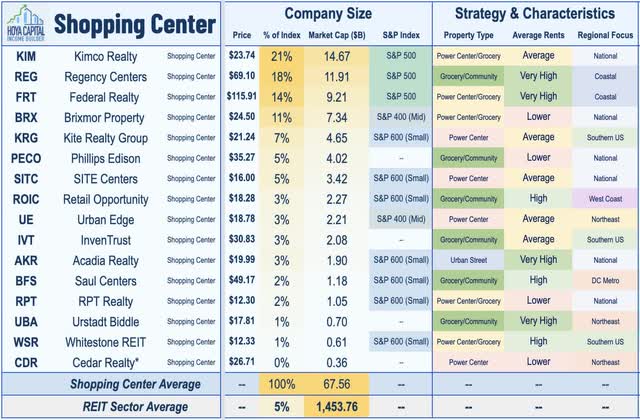

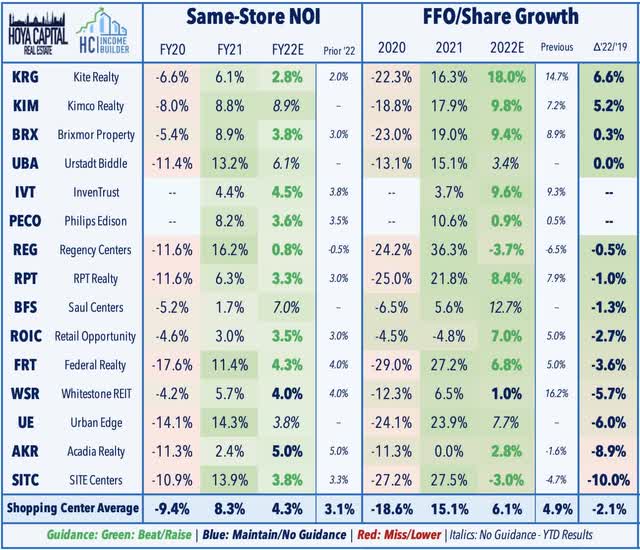

Shopping Center REITs are the second-best performing major property sector this year – significantly outpacing their mall REIT peers – despite the recent “retail rout” and moderation in stimulus-fueled retail spending trends. Unlike their mall REIT peers, Shopping Center REITs entered 2022 with fundamentals that are as strong – or possibly even stronger – than before the pandemic with a full recovery completed. While the enclosed regional mall format faces a choppy road to recovery, the outlook for open-air Shopping Center REITs has brightened considerably over the last several quarters. In the Hoya Capital Shopping Center REIT Index, we track the 16 largest open-air shopping center REITs, which account for roughly $70 billion in market value.

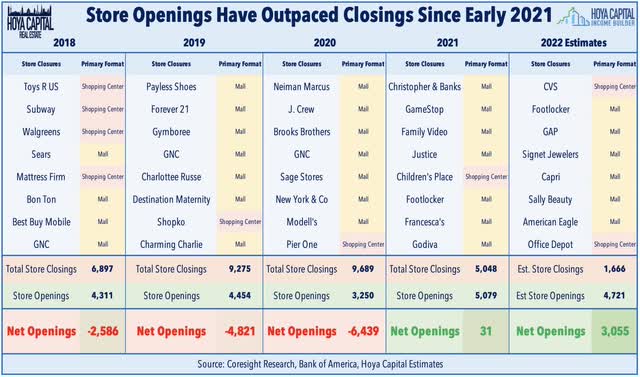

Hoya Capital

Critically, after a surge in store closings during the pandemic, the number of store openings has outpaced closings by nearly 2x since early 2021, according to Coresight Research, with particular strength in larger-format strip centers. After surging to around 10,000 in both 2019 and 2020, just 5,000 retail stores shut down in 2021 while 2022 is currently on pace for the lowest level of store closings on record with a total net store openings on pace to be over 3,000. Importantly, we believe that this slowed pace of store closings – particularly in the strip center format – goes beyond the near-term COVID-related trends and is indicative of a sustained retailer focus on highly efficient and well-located large-format space which can serve as hybrid showroom/distribution centers.

Hoya Capital

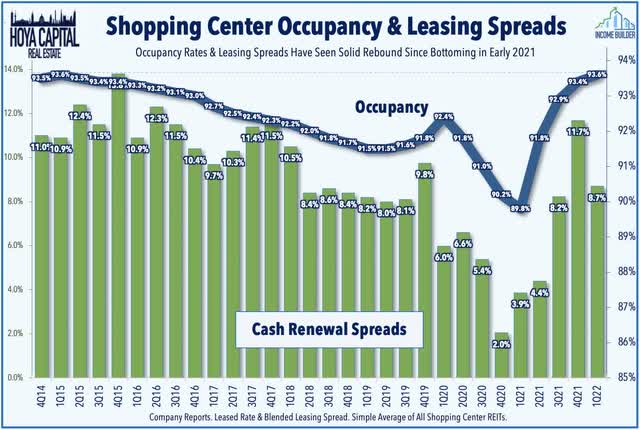

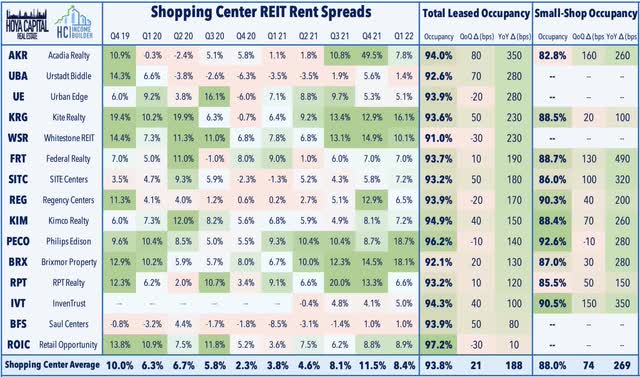

As discussed in our REIT Earnings Recap, recent shopping center REIT earnings results have been impressive – even if one was comparing to pre-pandemic standards – as occupancy rate trends and leasing spreads have been especially encouraging. Results in the first quarter pushed the average occupancy rate to the highest level since early 2015 at 93.6% while rental rate spreads have exhibited a notable acceleration since bottoming early last year. Rental rate spreads rose by over 8% for the third-straight quarter, indicating clear signs of pricing power for the first time since the mid-2010s. We noted early in the pandemic that, in exchange for rent deferrals, shopping center REITs were able to negotiate non-monetary concessions including waiving co-tenancy clauses, lifting use restrictions, and extending lease terms and we believe that some of these modifications are beginning to bear fruit.

Hoya Capital

Over the past four REIT earnings seasons beginning with Q2 2021, Shopping Center REITs have delivered the highest quantity of full-year guidance increases and the positive trend continued in Q1 with eleven of twelve REITs that provide guidance raising their full-year FFO outlook. Results from Kite Realty (KRG) were most impressive with a 330-basis point increase in its full-year FFO growth outlook to 18.0% – the strongest in the sector. Regency Centers (REG) was also an upside standout after reporting very strong results and raising its full-year outlook, boosting its full-year FFO outlook by 280 basis points and its SSNOI outlook by 130 bps. Kimco (KIM) also reported very strong results and significantly raised its full-year FFO growth outlook to 8.8% – up 280 basis points from its prior guidance.

Hoya Capital

Strong leasing activity has been the positive highlight of the past several quarters and unlike their mall REIT peers, leasing volumes and rental rates have picked up considerably since early 2021. Encouragingly, leasing spreads stayed positive throughout the pandemic and meaningfully accelerated for four straight quarters with blended leasing spreads rising by double-digit rates for the first time since mid-2017. Led by Acadia Realty (AKR) and Urstadt Biddle (UBA), total occupancy rates improved 20 basis points from Q4 and 188 bps from the prior year while small-shop occupancy recorded a nearly 300 basis point from Q1 2021 which appears to have indeed been the “bottom” of a decade-long skid in occupancy and spreads.

Hoya Capital

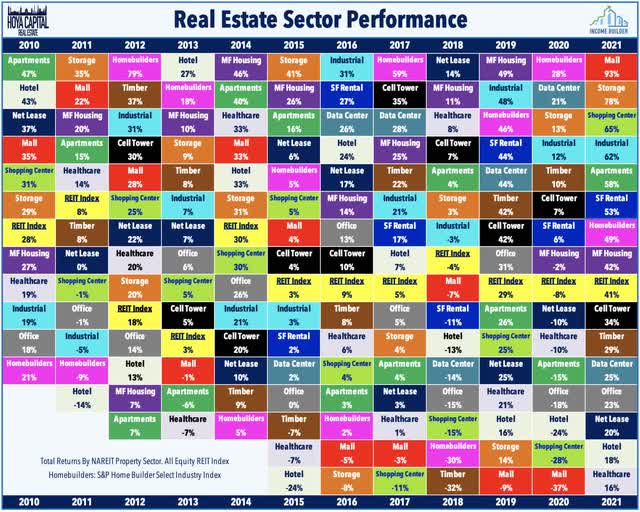

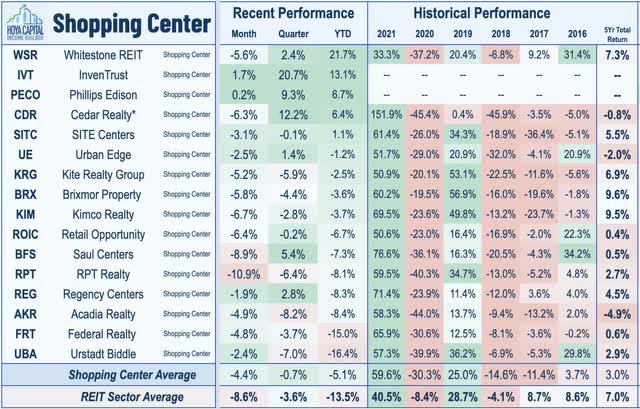

Shopping Center REIT Stock Performance

After plunging more than 50% early in the pandemic, shopping center REITs have been one of the best-performing property sectors since the initial vaccine announcements in mid-November 2020. Shopping center REITs snapped a five-year streak of underperformance in 2021 with total returns of more than 65%, significantly outpacing the 41% total returns from the broad-based FTSE Nareit All Equity REITs Index. While the gap has closed considerably since late 2021, retail landlords are still significantly underperforming the performance of their tenants since the start of the pandemic as the SPDR S&P Retail ETF (XRT) has returned more than 50% since the start of 2020 compared to the roughly 20% average cumulative returns by these REITs over this time.

Hoya Capital

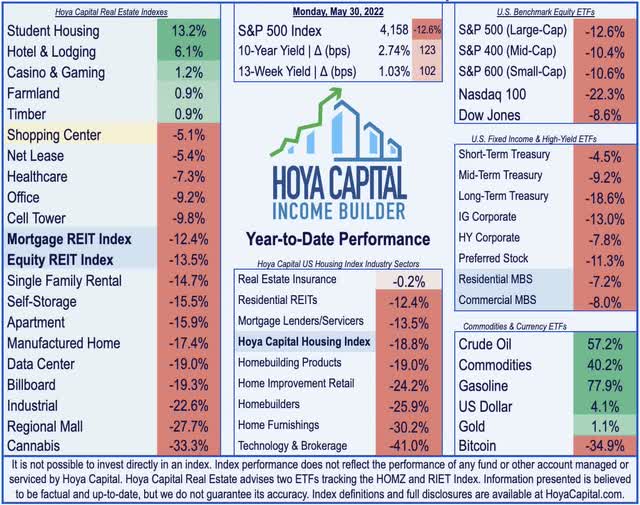

Two steps forward, one back. A common theme across the shopping center sector over the past several years, new reasons for caution always seem to emerge just as investors were starting to feel confident in the outlook. Soaring gas prices and persistent inflation have tempered the post-pandemic optimism, but absent an outright recession, we believe that the positive fundamental trajectory should continue into 2023. Shopping center REITs are still among the stronger-performing sectors so far in 2022 with price returns of -5.1% compared to the 13.5% decline from the Vanguard Real Estate ETF (VNQ) and 12.6% decline from the S&P 500 (SPY).

Hoya Capital

Diving deeper into the company-level performance, five of the sixteen shopping center REITs are in positive territory this year, led on the upside by Whitestone REIT (WSR), InvenTrust (IVT), and Phillips Edison (PECO). Cedar Realty is also among the leaders this year after announcing it will sell the majority of its portfolio – 33 shopping centers valued at roughly $900m – to private equity firm DRA Advisors while the remainder of its assets – 18 properties valued at roughly $290m – will be acquired by Wheeler Real Estate (WHLR). CDR will become wholly owned by Wheeler and CDR’s stock will no longer be publicly traded, but CDR’s preferred issues will remain publicly traded under Wheeler – which has not paid a dividend on its preferreds since 2018 – a controversial issue that has triggered shareholder litigation.

Hoya Capital

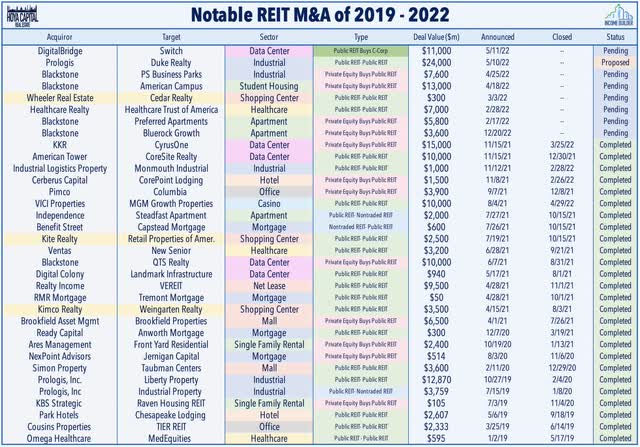

Shopping Center M&A And External Growth

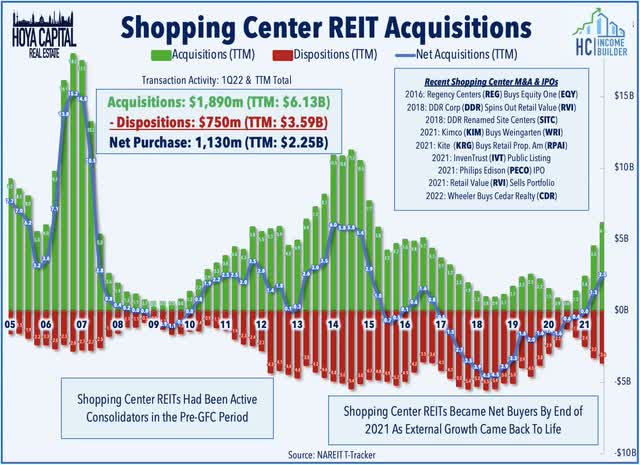

We’ve also seen the “animal spirits” come alive over the last twelve months across the shopping center REIT sector with several mergers, two new listings, and the highest level of acquisitions since the mid-2010s. Kimco Realty (KIM) and Weingarten Realty closed on their merger last August while Kite Realty closed on its acquisition of Retail Properties of America last October. Back in March, Cedar Realty (CDR) announced that it will sell to small-cap diversified REIT Wheeler Real Estate (WHLR) in a controversial deal that we’ll discuss in more detail below. Two sizable new public REITs have emerged as well, graduating from the “non-traded” REIT ranks: InvenTrust Properties (IVT) went public through a “Dutch Auction” last October while Phillips Edison went public through an IPO last July.

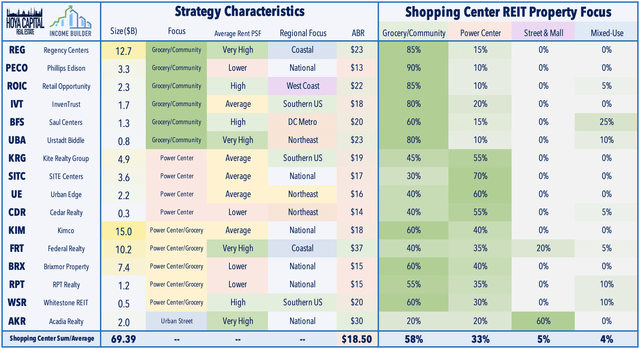

Hoya Capital

InvenTrust Properties – with a market cap of $1.7B – owns 65 open-air shopping centers, representing 10.8M square feet of retail space, primarily in the Sunbelt region. The company reports that over 85% of NOI comes from grocery-anchored shopping centers and its portfolio has an average base rent of $18-19. Phillips Edison & Company is one of the nation’s largest owners and operators of grocery-anchored shopping centers with a portfolio comprised of 278 wholly-owned shopping centers across 31 states. Grocery-anchored centers have historically commanded premium valuations relative to power centers and REITs with a heavier balance of grocery-anchored centers have generally delivered steadier operating performance throughout the pandemic.

Hoya Capital

Prior to the share price rebound that began in late 2020, a sharp disconnect had persisted between private market valuations of retail real estate assets and the REIT-implied valuation, forcing retail REITs to be net sellers of assets for nearly a half-decade. The tide turned since mid-2021, however, as shopping center REITs became net buyers for the first time since 2016, acquiring $4.45B in assets during the year while selling $3.14B for a net positive total of $1.31B. Nevertheless, a pair of small-cap REITs that traded at persistent Net Asset Value discounts headed for the exits – recognizing significant shareholder value in the process: Retail Value (RVI) sold the majority of its portfolio this year in two separate transactions while the aforementioned Cedar Realty (CDR) will sell the majority of its portfolio before being acquired by Wheeler.

Hoya Capital

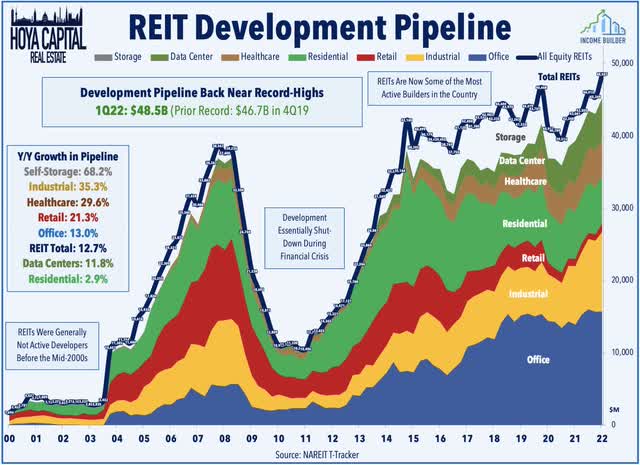

Importantly, after a development boom during the 1990s and early 2000s, a limited amount of new retail space has been created since the Financial Crisis and the retail development pipeline remains almost non-existent, declining another 12.1% in 2021 to its lowest level in nearly 20 years. Despite that, the US still has more retail square footage per capita than any other country in the world, but the gap between total spending and square footage has narrowed rather significantly over the past half-decade. The majority of new retail development by shopping center REITs has been through redevelopment or modest expansions of existing properties with only a handful of complete ground-up construction.

Hoya Capital

Deeper Dive: Retail Sales & Omnichannel

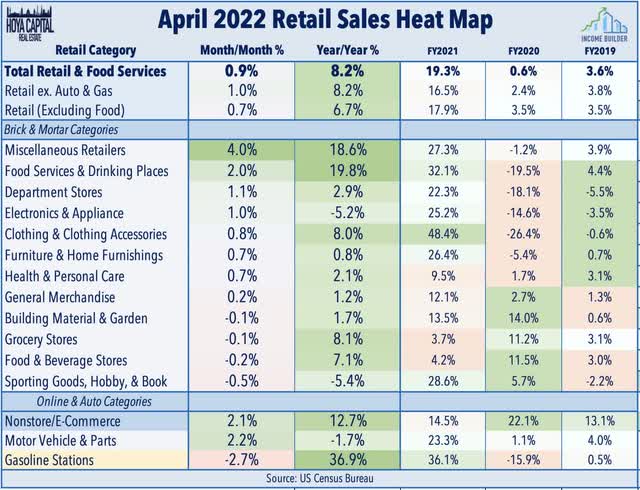

Powered by WWII levels of fiscal stimulus, retail sales set record-after-record throughout 2021, and while recent retail earnings reports suggest that the stimulus-fueled spending spree has shown some signs of moderation in 2022, retailers are generally far healthier in early 2022 than they were before the pandemic. Regaining all of the lost ground during the pandemic by early 2021, the strength in retail sales has been led by many of the “big box” categories including home improvement, general merchandise, grocery, sporting goods, electronics/appliances, and home furnishings stores. The Census Bureau reported last week that retail sales rose at a stronger-than-expected rate in April, and recorded its fourth-straight month of growth.

Hoya Capital

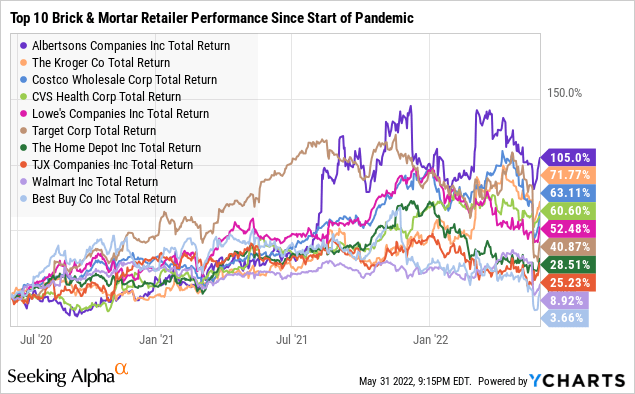

It took a few years, but Big Box retailers have learned to compete effectively in the e-commerce era. Despite their slide in the past month, the ten largest brick-and-mortar retailers have posted average returns of roughly 50% since the start of 2020. While the momentum slowed in early 2022 amid inflation challenges and the waning of stimulus Earnings reports from Home Depot (HD) and Lowe’s (LOW) were historically strong throughout 2021, as were earnings results from many of the largest “big-box” general merchandise retailers including Walmart (WMT), Costco (COST), and Target (TGT). The large publicly traded grocers have also seen renewed strength driven by the pandemic including Albertsons (ACI) – which has surged more than 100% since its listing in June 2020, and Kroger (KR) – which has gained 70%.

Hoya Capital

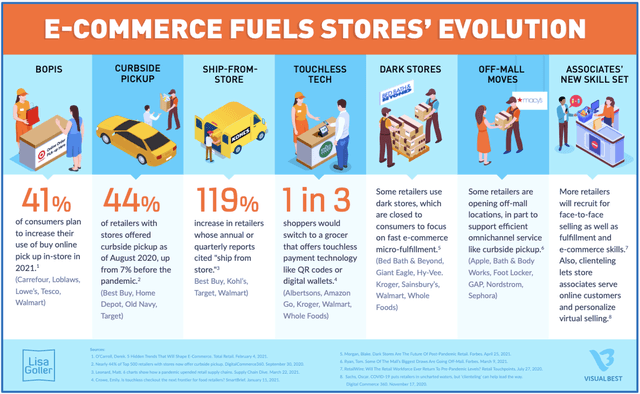

The growing usage of alternative (and higher-margin) “delivery” options including in-store pickup, “curbside” pickup, and delivery-from-store have been a tailwind for well-located shopping center REITs. Shopping centers have increasingly become hybrid distribution centers in a decentralized third-party delivery network powering “same-hour” delivery to challenge Amazon’s (AMZN) dominance in ultra-fast delivery. The pandemic significantly accelerated retailers’ investment in their in-store order fulfillment platforms which has evolved from a pure “click and collect” model into a multi-channel “last-mile” delivery network supplemented by delivery platforms like Uber (UBER), Postmates (POSTM), and DoorDash (DASH) as the food delivery model is becoming more ubiquitous across all retail categories.

Hoya Capital

Not all shopping centers are equally well-suited for this evolution, however, and many retail locations lack the logistical infrastructure – location, parking, ease of pickup – to serve as hybrid fulfillment hubs. We believe that the longer-term outlook for most open-air strip centers remains far more promising than their regional mall REIT peers due precisely to their physical layout and strategic importance in the retail fulfillment network.

Hoya Capital

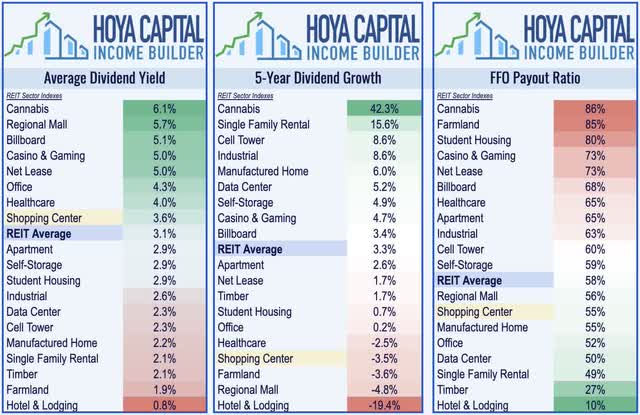

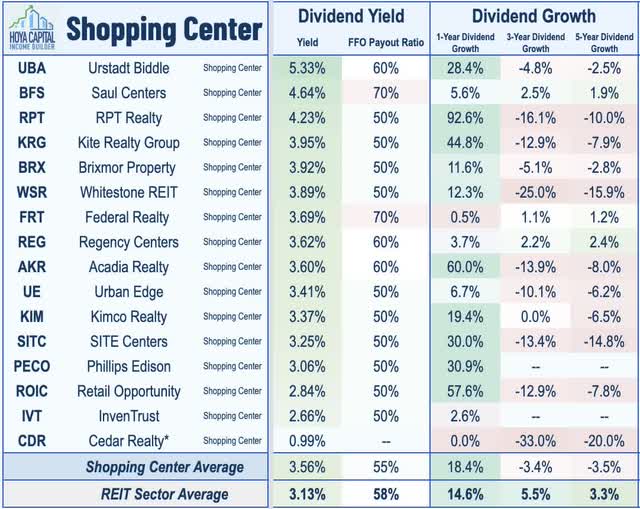

Shopping Center REIT Dividend Yields

Helped by the eighteen dividend increases across the sector in 2021 and another eight so far in 2022, shopping center REITs currently pay an average dividend yield of 3.6%, which is well above the market-cap-weighted REIT sector average of 3.1%. Shopping center REITs pay out only about half of their FFO, leaving significant embedded upside potential for dividend growth and we expect a similar quantity of dividend increases in 2022.

Hoya Capital

Diving deeper into the sector, we note that dividend yields range from a sector-high of 5.33% and 4.64% from small-caps Urstadt Biddle (UBA) and Saul Centers (BFS) to a sector-low of 0.93% from Cedar Realty (CDR). Notably, three REITs in the sector have recorded positive dividend growth over each of the one, three, and five-year time horizons – Regency Centers (REG), Federal Realty (FRT), and Saul Centers (BFS).

Hoya Capital

Key Takeaways: Reiterating Positive Outlook

For shopping center REITs, the versatility and larger footprint of the strip center format have been a winning formula as retailers have increasingly utilized their brick-and-mortar properties as hybrid “distribution centers” in last-mile delivery networks. After a surge in store closings during the pandemic, the number of store openings has outpaced closings by nearly 2x since early 2021 with particular strength in larger-format strip centers. As a result, shopping center fundamentals are now strong– if not stronger than before the pandemic, underscored by a rise in occupancy rates to the highest level since early 2015 while rental rates continue to accelerate.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

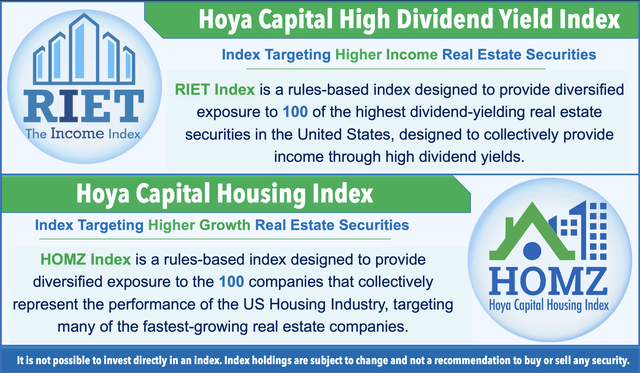

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

[ad_2]

Source link