Ways to Monitor Your Ecommerce Site for Credit Card Fraud

[ad_1]

In accordance to Michigan Retailer Association’s study of retail revenue offered in its 2021 Buy Nearby Examine, countrywide ecommerce revenue grew from 8.8 p.c of total retail product sales in 2017 to 10.7 percent in 2019, and then jumped yet again to 13.6 per cent in 2020. Despite the fact that this information and facts is tough to delineate at a point out-stage, there is no question that Michigan’s retail sector has probable been through a equivalent transformation.

Amid the COVID-19 pandemic, adding ecommerce as a method for offering has been vital for numerous Michigan vendors. With no it, a lot more shops would not have survived the pandemic.

As on-line income mature, so does fraud

As a lot as stores have benefited from ecommerce gross sales, on-line credit history card fraud has jumped considerably across the U.S. According to LexisNexis, U.S. ecommerce retailers documented a 140 per cent boost in fraud assaults because 2020. On top of that, in accordance to a the latest write-up in Organization Insider, card-not-current (CNP) fraud is predicted to increase by 14 percent in the following 4 many years.

A single of the most prevalent techniques cyber criminals get stolen credit score card quantities is as a result of the darkish website. Most stop by a web site on the dim web and buy stolen credit score cards in bulk with the target of screening them to obtain the kinds that get the job done. In 2019, there were at the very least 23 million stolen credit rating card quantities for sale on the darkish internet. That quantity has only greater given that then.

What does this fraud necessarily mean to your small business? Consider additional chargebacks, penalties, lost earnings, and a new reputation amongst criminals that your organization is an simple concentrate on.

I say this often: fraud prevention is a journey, not a spot. Cyber criminals are pretty innovative and they modify solutions often and generally. There are, having said that, a few steps you can just take that will enable you avert fraud throughout a transaction. They can expose a probable credit history card theft in the making.

- Do you choose recognize if your terminal ordeals an EMV chip malfunction?

Although most of this posting is linked to ecommerce, just one of the methods that negative fellas use stolen card numbers is via a facial area-to-encounter transaction that is not “dipped” into the chip reader.

Despite the fact that most merchants use an EMV chip reader, terminals are established up to permit for transactions to be processed using a magnetic strip to accommodate more mature playing cards without chips, or playing cards with malfunctioning chips. This is the loophole that criminals are now exploiting.

If a negative guy has a very good card amount (and the associated data from the magazine stripe), they can encode that on a respectable card and then injury the card’s EMV chip. This will pressure your terminal to settle for a swipe (with the stolen card number on the mag stripe, as an alternative of the respectable card quantity).

When they make a invest in, they insert the card in the chip reader, which will report an mistake for the reason that the chip are unable to be study. Then, they will explain to the clerk that they’re obtaining challenges with the EMV chip on their card and question if they can complete the transaction by possibly swiping the magnetic strip or obtaining the clerk vital in the account amount, bypassing the EMV chip reader all collectively.

Get notice, you need to be vigilant with your workers about normally applying an EMV chip reader. The main card networks have distinct principles about this. If a merchant will allow a shopper with an EMV chip credit rating card to make a purchase by swiping the card in lieu of working with the chip reader, any chargebacks filed versus the transaction will immediately be identified in the cardholder’s favor.

Alert your team to choose observe when this takes place, specially if it is a substantial-ticket variety this kind of as jewelry, appliances, or a laptop. If your EMV chip reader carries on to fall short, it may well be time to update your process.

- Does your internet site have to have a three-digit protection code for all online transactions?

In accordance to a 2021 Nilson Report on credit score card fraud, the sum of funds lost to card-not-current fraud in 2020 was six moments higher than what merchants shed just a single 12 months earlier. Hence the need to make confident that any purchases produced on your web page involve a protection code.

A credit history card security code, generally recognised as the card verification worth 2(or CVV2) is the three or four -digit code ordinarily discovered on the back of a credit card. The CVV2 gives an added layer of security by verifying that the purchaser is in possession of the card.

To remain PCI compliant, you are not permitted to retail outlet CVV2 codes on your procedure. This aids in safeguarding prospects from a info breach and tends to make it tough for cyber criminals to get a customer’s CVV2. Not complying with world-wide PCI Information Security Requirements could result in significant fines or even worse – the cancellation of your merchant processing obtain by the payment processor.

- Does your web-site incorporate a CAPTCHA as element of the checkout procedure?

Just one of the issues that lousy men have is figuring out if the card numbers that they bought on the darkish website are continue to active and “good.”

A typical online system employed by criminals is accessibility web sites to exam a group of stolen playing cards by conducting reduced-amount transactions, typically $1 or $2 to uncover the cards that are nevertheless energetic. This type of account testing is recognised as “card tumbling.” Just one of the main outcomes of getting a target of a card tumbling assault like this is the significant costs your account can occur if the scale of the attack is considerable. Some illustrations of expenses include things like authorization, clearing and settlement, interchange, and gateway transactions.

Everything you can do to sluggish down the method of finding an authorization try on a transaction retains card tumblers at bay. This is exactly where including a CAPTCHA as part of your on the web checkout approach plays a essential position. According to Dictionary.com, the origin of CAPTCHA stands for “completely automatic community Turing examination to tell computers and people apart.” It is a variety of problem-reaction examination used to determine whether the person is a human or a bot. To go the test, buyers should interpret distorted textual content by typing in right letters into a variety subject. In the case of a re-CAPTCHA, the consumer is required to identify a established of objects in a picture.

Despite the fact that CAPTCHAs get their truthful share of critics, they’ve accomplished a tremendous occupation in preserving ecommerce internet sites from brute pressure attacks.

As pointed out at the commencing of this report, this system of defending oneself is a journey, not a spot. It is some thing that you should be paying focus to routinely.

As generally, if you have thoughts about this concern or any other service provider processing challenge, please do not wait to get hold of our buyer assistance crew at 800.563.5981

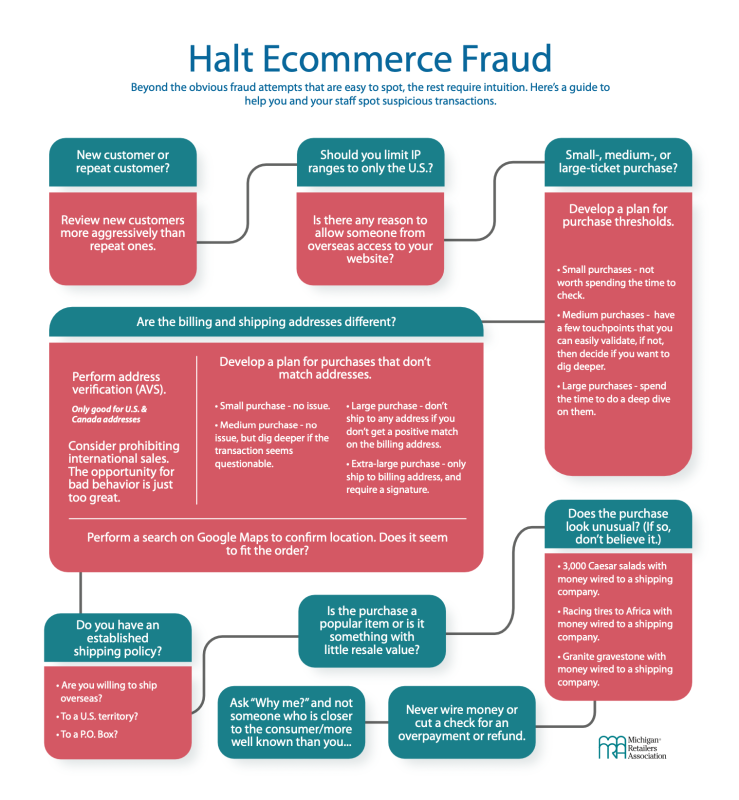

Use this Ecommerce Fraud Conclusion Tree graphic to enable you and your staff spot suspicious transactions.

[ad_2]

Source website link